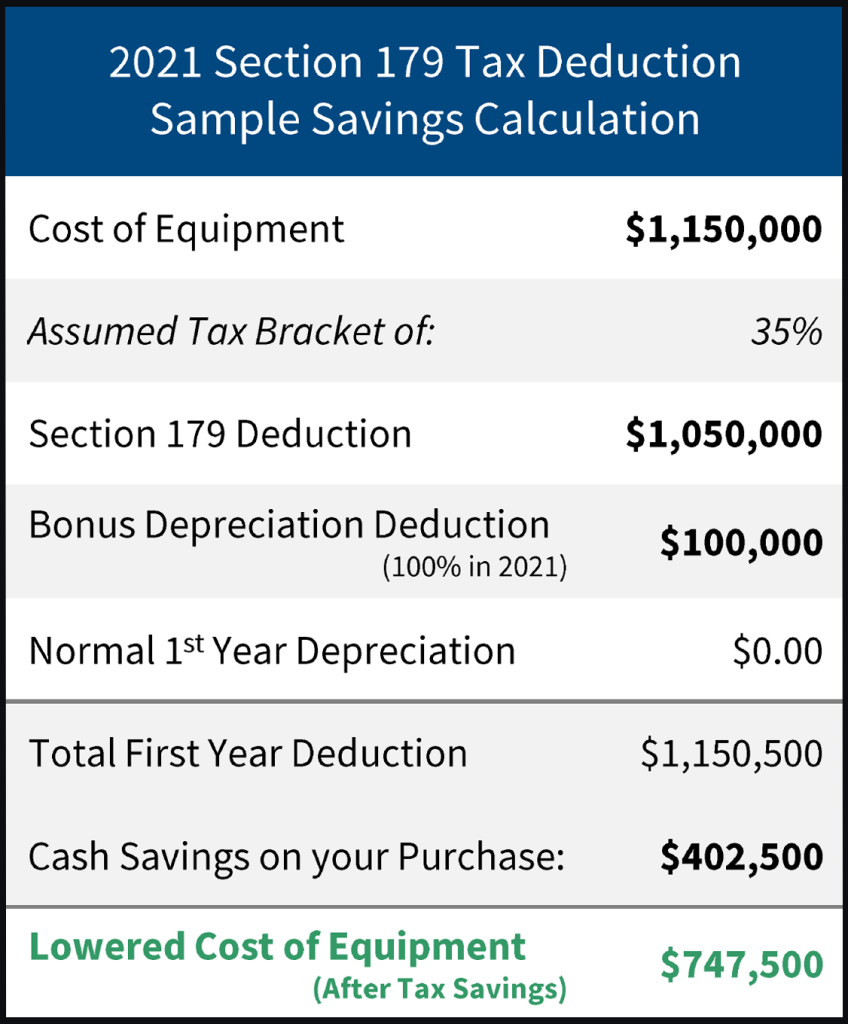

2021 Section 179 Deduction Limit Has Increased to $1.05 Million

Successful businesses take advantage of legal tax incentives to help lower their operating costs. The Section 179 Deduction is a tax incentive that is easy to use and gives businesses an incentive to invest in themselves by adding capital equipment. In short, taking advantage of the Section 179 Deduction will help your business add equipment and software, while allowing you to keep more of your tax dollars.

Common Section 179 Questions

What is the Section 179 Deduction?

Essentially, Section 179 of the IRS tax code allows businesses to deduct the full purchase price of qualifying equipment and/or software purchased or financed during the tax year. That means that if you buy (or lease) a piece of qualifying equipment, you can deduct the FULL PURCHASE PRICE from your gross income. It’s an incentive created by the U.S. government to encourage businesses to buy equipment and invest in themselves.

What Types of Equipment Qualify?

This deduction is good on new and used equipment, as well as off-the-shelf software. To take the deduction for tax year 2021, the equipment must be financed or purchased and put into service between January 1, 2021 and the end of the day on December 31, 2021. A few examples are listed below, or you can click here for a list of qualifying property.

- Equipment (machines, etc.) for business use

- Computers

- Computer “Off-the-Shelf” Software

- Office Equipment

Do Supply Chain Issues Effect the Deadline?

Please note that to be eligible for a 2021 Section 179 deduction, the eligible equipment must be purchased and put into service by midnight 12/31/2021. It is not enough to simply buy the equipment. Please keep supply chain issues and delivery times in mind when buying or using Section 179 Qualified Financing, as unfortunately there are currently no plans to waive the “put into service” requirement.

Use the 2021 Section 179 Calculator on the official Section 179 website to see how much your company can save.